Currency fluctuations: Monitoring the impact on the project

Apr 10, 2024

3 min read

Projects involving international transactions, exchange rate fluctuations can have a considerable impact on project finances. It is a common practice for corporate finance organizations to take the lead on managing these fluctuations. Nevertheless, the project organization needs to have the tools available to monitor the impact and provide valuable information to key stakeholders.

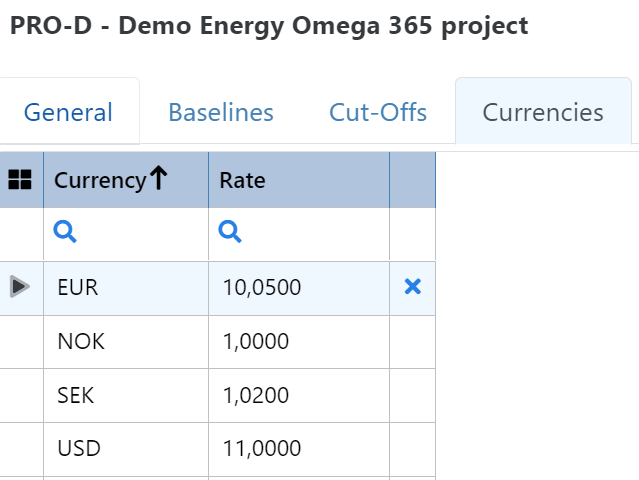

- Setting exchange rates assumption: When a project is approved, the exchange rates for the project are typically set. The expected exchange rates may need to be adjusted during the project. This should then be done as part an update of the baseline.

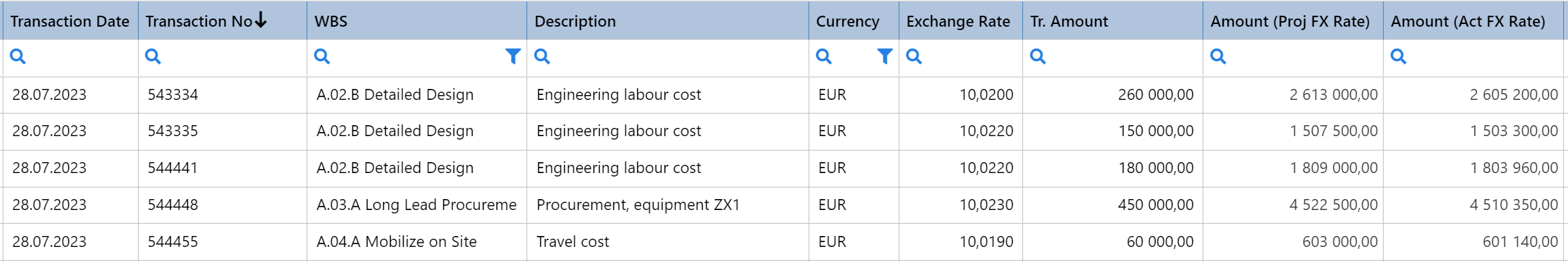

The exchange rates assumptions are registered in the Project Setup app. - Currency impact calculation: Once the exchange rates are established, project cost estimates are populated using these predefined rates. However, actual exchange rates may fluctuate over the project's duration, impacting the project's financial performance. The currency impact is calculated by comparing the difference between the amounts based on the predefined exchange rates, and the actual exchange rates at the time of the transaction. If a WBS element is defined for currency impact, the currency impact is registered as actual cost on that WBS element.

When receiving the transactions from the accounting system, the actual exchange rates are included. The currency impact is the difference between the cost using the actual exchange rate, and the assumed exchange rate for the project.

When receiving the transactions from the accounting system, the actual exchange rates are included. The currency impact is the difference between the cost using the actual exchange rate, and the assumed exchange rate for the project. - Monitoring and reporting: It is a common practice to add a currency impact element to the WBS. It is commonly set at the root level, to ensure that the currency impact is reported separately.

E.g:

A - Project Cost

A.01 Management

A.02 Engineering & Procurement

A.03 Construction

B Currency Impact

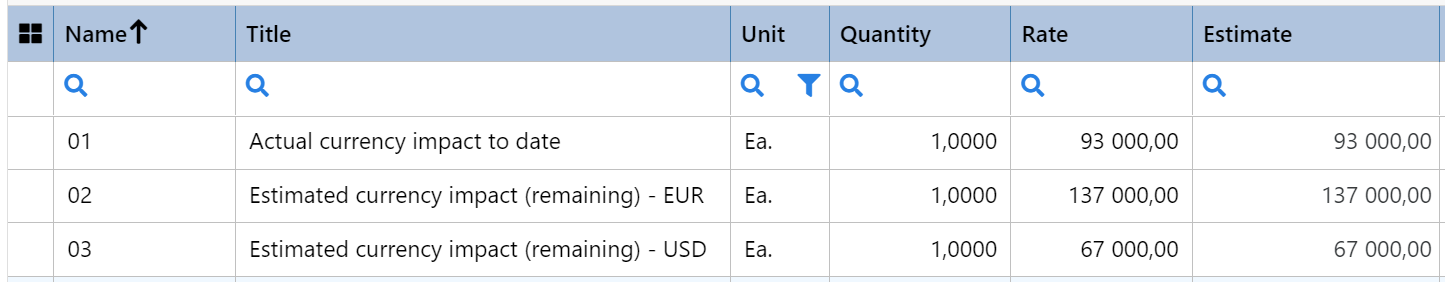

This way, the currency impact is not included when the report is for WBS "A - Project Cost" - Forecasting: The time phasing for each WBS is done in the project currency only and not phased separately per currency. However, the cost for each estimate line item and contract cost item can be specified per currency. You can then use this information to aid in forecasting potential currency impact on work that is not contracted yet, or contracted but not yet performed. This type of forecasting is done outside Omega 365, typically in Excel, and needs to take into account timing of milestone payments. The result of this analysis can be used to update the estimate for the "Currency Impact" WBS element.

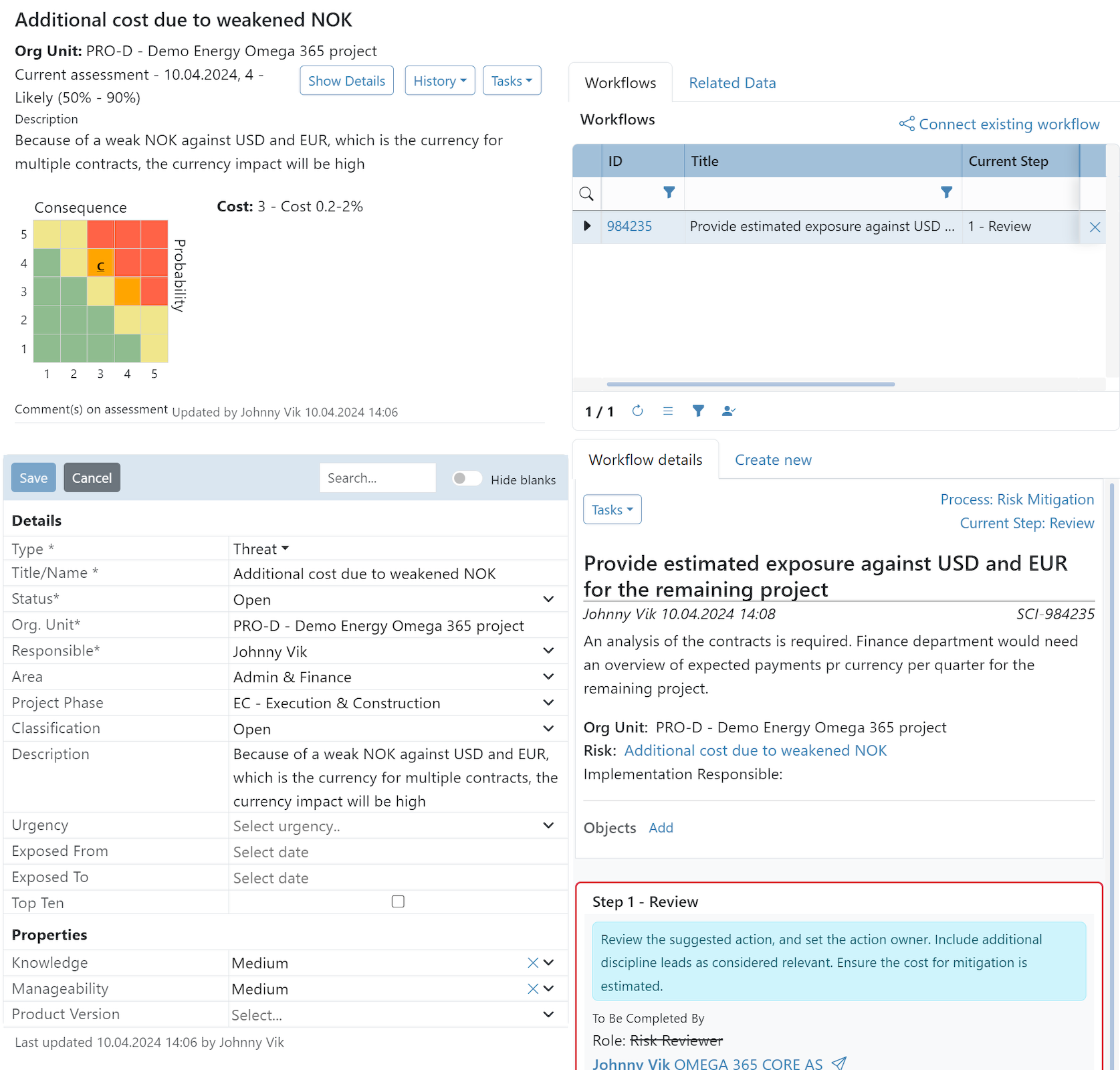

The actual currency impact to date, and the estimated currency impact for the remaining project are registered as estimate items. - Risk Management: The risk register can be used to document the risks related to currency fluctuations, including identifying and follow-up of mitigating measures

The Risk register, and workflows for following up mitigating measures, can be used to manage the risks related to exchange rate fluctuations.